1905

Modern banking in Ethiopia was first introduced in 1906 when the Bank of Abyssinia was established based on the agreement being reached between the Ethiopian government and the British owned National Bank of Egypt. Bank Abyssinia was inaugurated by Emperor Menelik II on February 16, 1906.

1931

In 1931, Emperor Haile Selassie introduced reforms into the banking system. The Ethiopian government purchased the Abyssinian Bank, which was the dominant bank, and renamed it the Bank of Ethiopia—the first nationally owned bank on the African continent. The Bank of Ethiopia provided central and commercial banking services to the country.

1936

During the five years of Italian invasion (1936-41) banking activity expanded. The Italian banks were particularly active. After the liberation, where the role of Britain was paramount owing to its strategic planning during the Second World War, Barclays Bank was established and remained in business in Ethiopia between 1941 and 1943.

1943

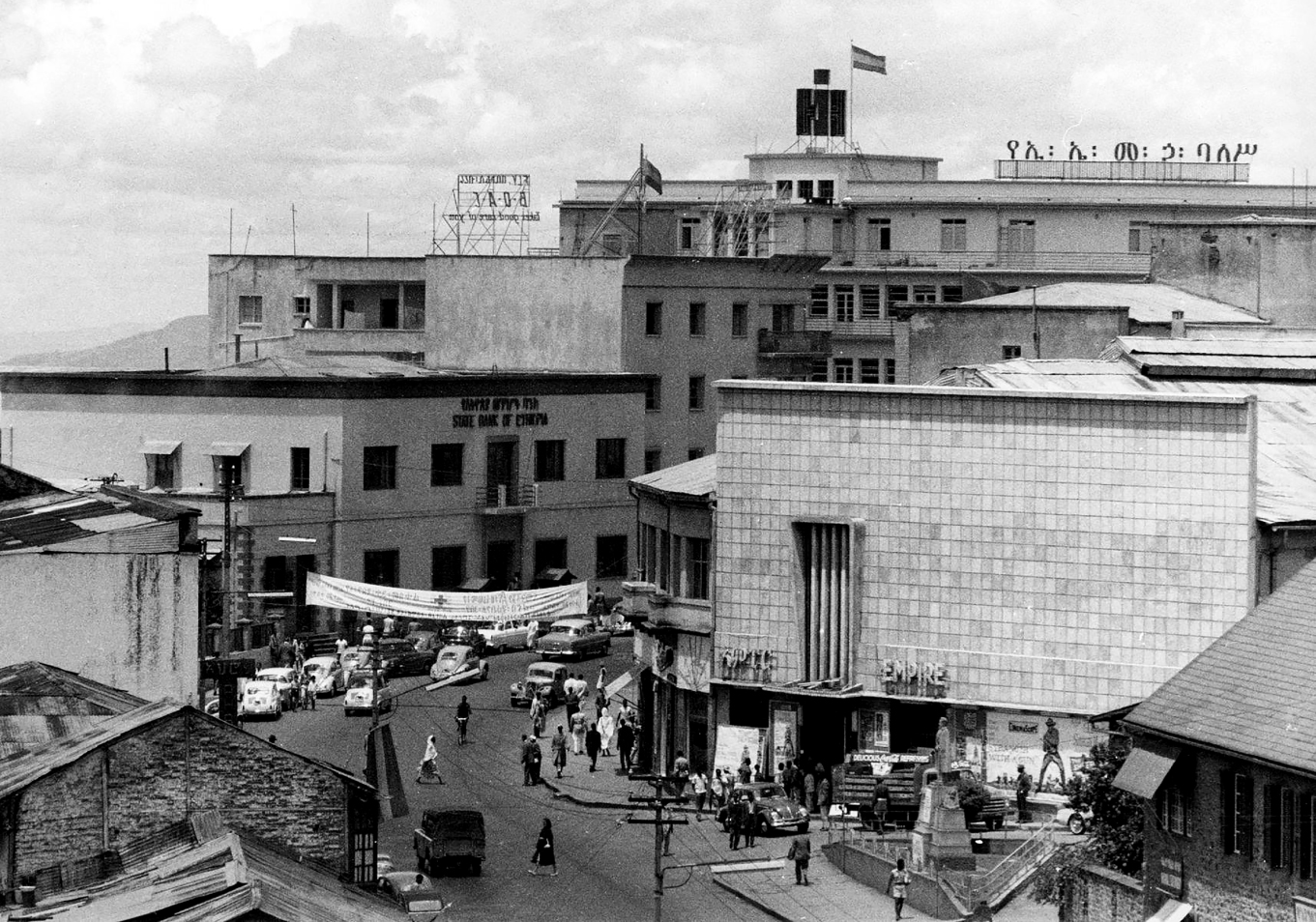

On April 15, 1943, the State Bank of Ethiopia became the Central Bank. Like its predecessor, the Bank combined a central banking and commercial banking operations. By the time it ceased operations in 1963, the State Bank of Ethiopia had established 19 domestic branches, a branch in Khartoum, and a transit office in Djibouti.

1963

In 1963, the State Bank of Ethiopia was split into the National Bank of Ethiopia and Commercial Bank of Ethiopia thereby clearly demarcating central banking and commercial banking operations. The National Bank of Ethiopia was established in 1963 by Proclamation 206 of 1963 and began operation in January 1964.

1975

On September 1, 1976, Monetary and Banking Proclamation No. 99 of 1976 went into effect, defining the National Bank’s duty in accordance with the country’s socialist economic principles adopted during the Dreg regime. Besides Actively participating in national planning, the Bank’s supervisory and regulatory role expanded to insurance institutions, credit cooperatives and investment banks. In addition, the Ethiopian Dollar was replaced by the Ethiopian Birr as the legal tender.

1994

Following the regime change in 1991 and the liberalization policy that began in 1992, many financial institutions were reorganized to operate largely on a market-oriented policy framework. The Monetary and Banking Proclamation No. 83 of 1994 established the National Bank of Ethiopia as a judicial entity separate from the government and defined its roles, functions, and expected duties.

2008

The National Bank of Ethiopia underwent a major restructuring and its regulatory and supervisory role strengthened after Proclamation No. 591 of 2008 went into effect. New financial products and innovations such as mobile banking, internet banking and digital finance were introduced and helped accelerate access to finance and financial inclusion. As a number of new banks and MFIs joined the financial industry, financial intermediation got boosted. Of recently, the government has also decided to liberalize the financial sector by allowing the banking sector for foreign investment.

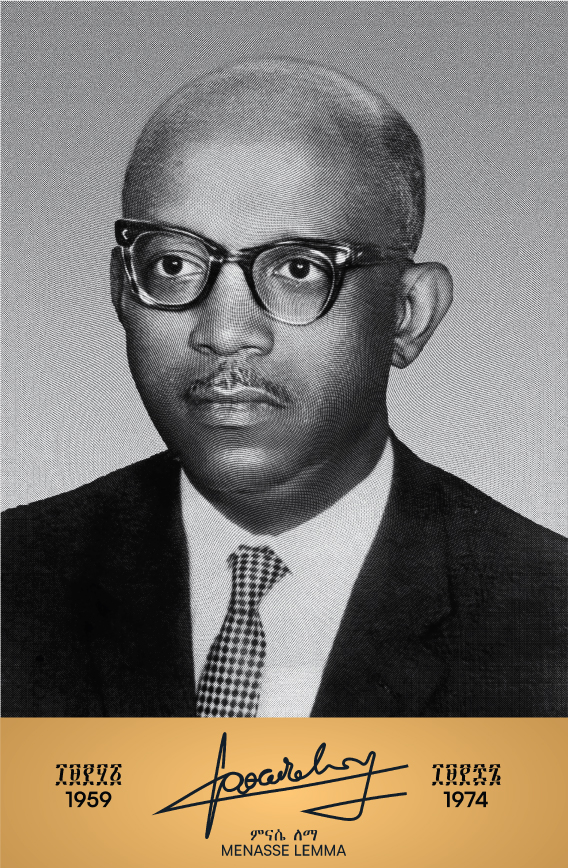

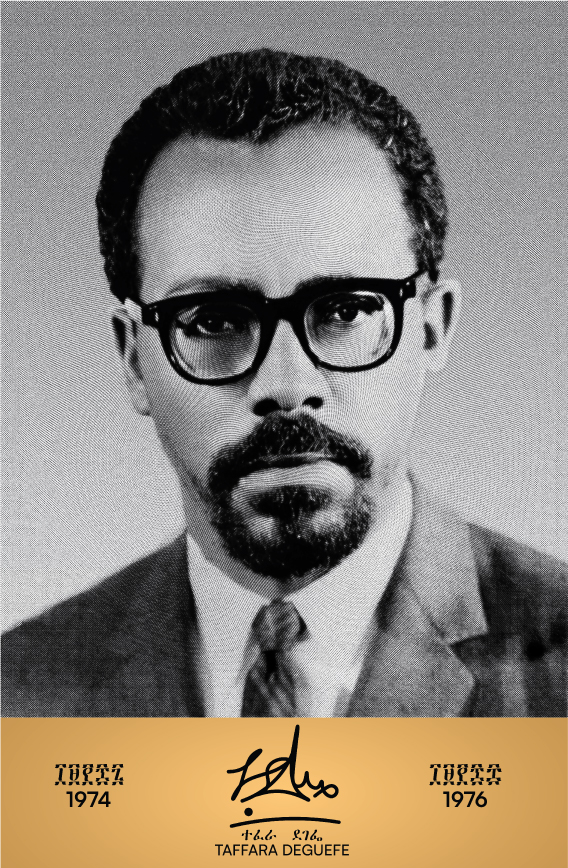

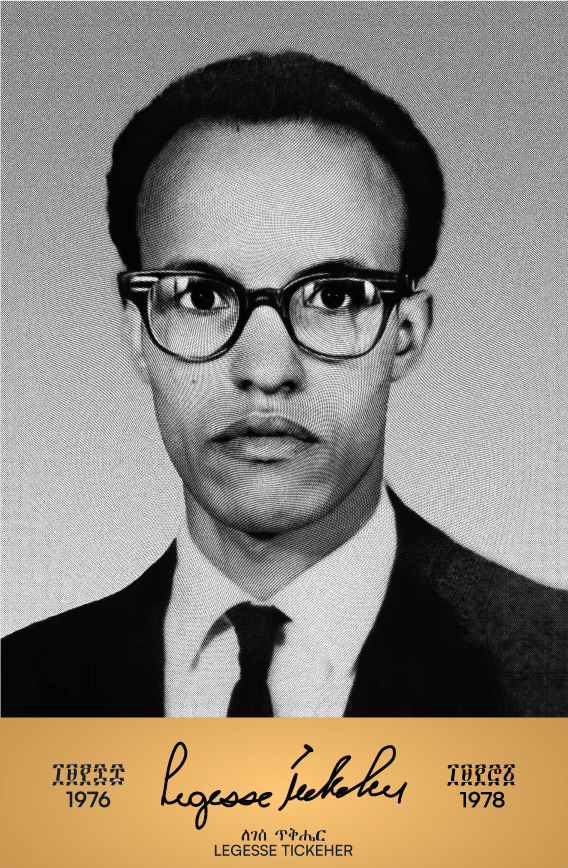

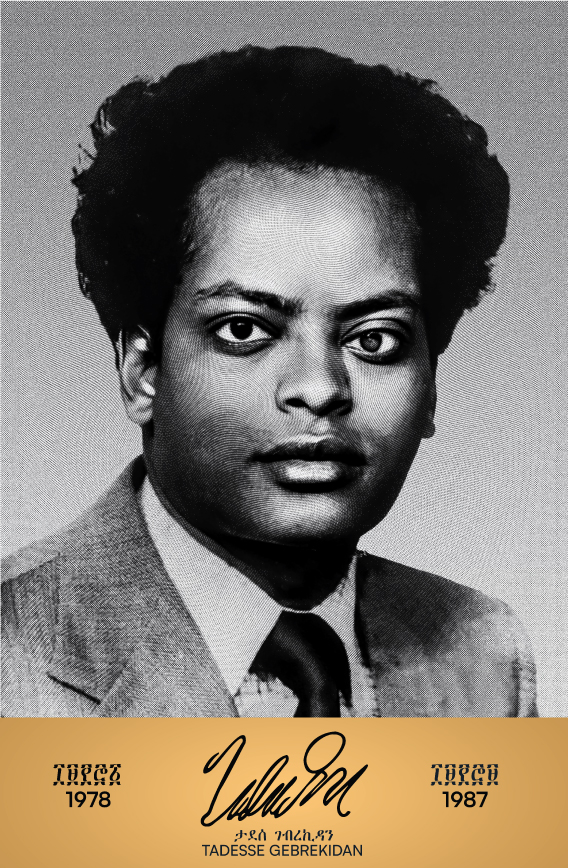

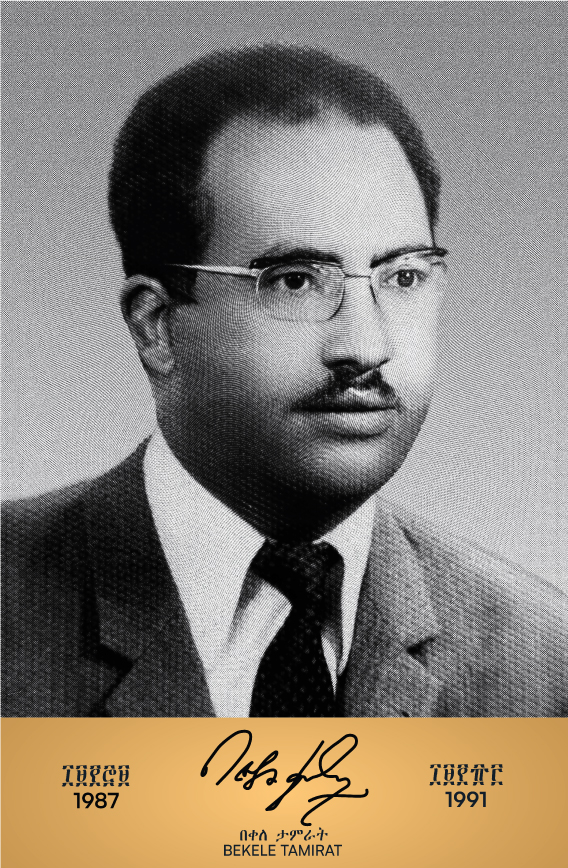

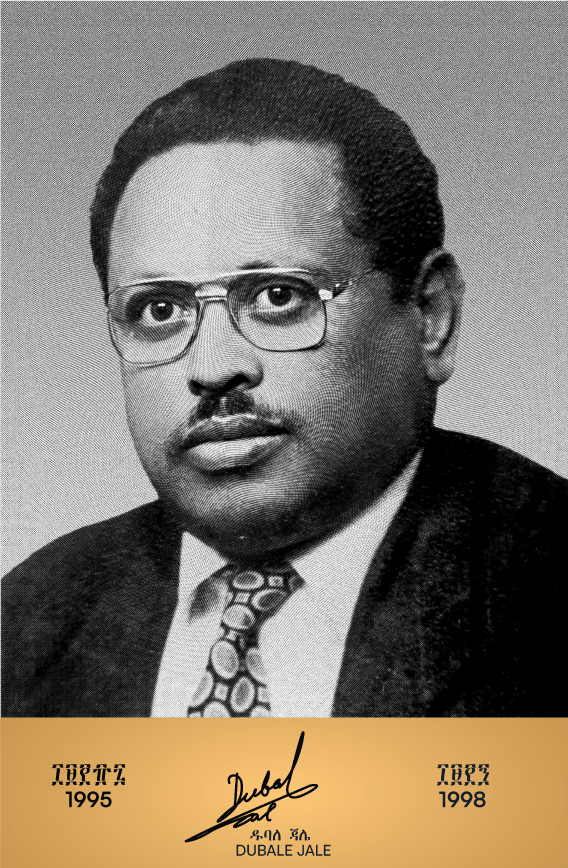

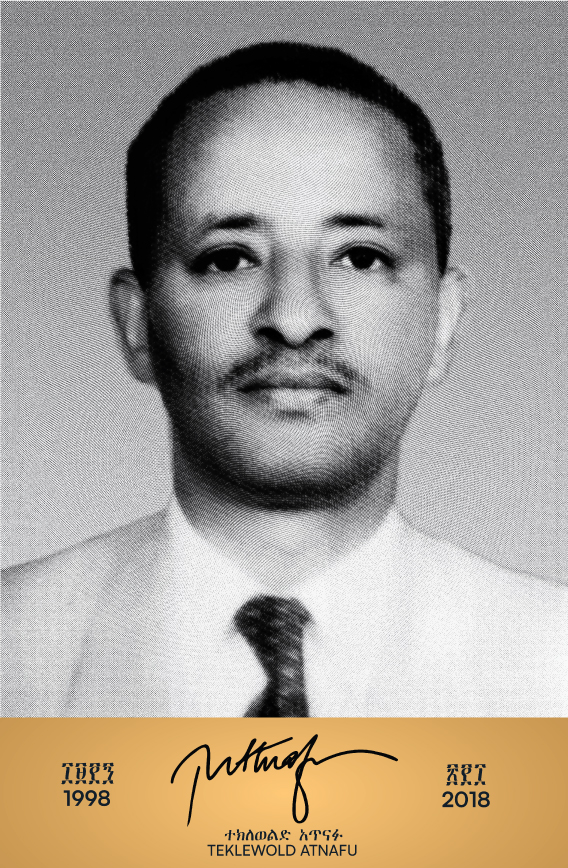

FORMER GOVERNORS