SPECIAL FOREIGN EXCHANGE SALE AUCTION

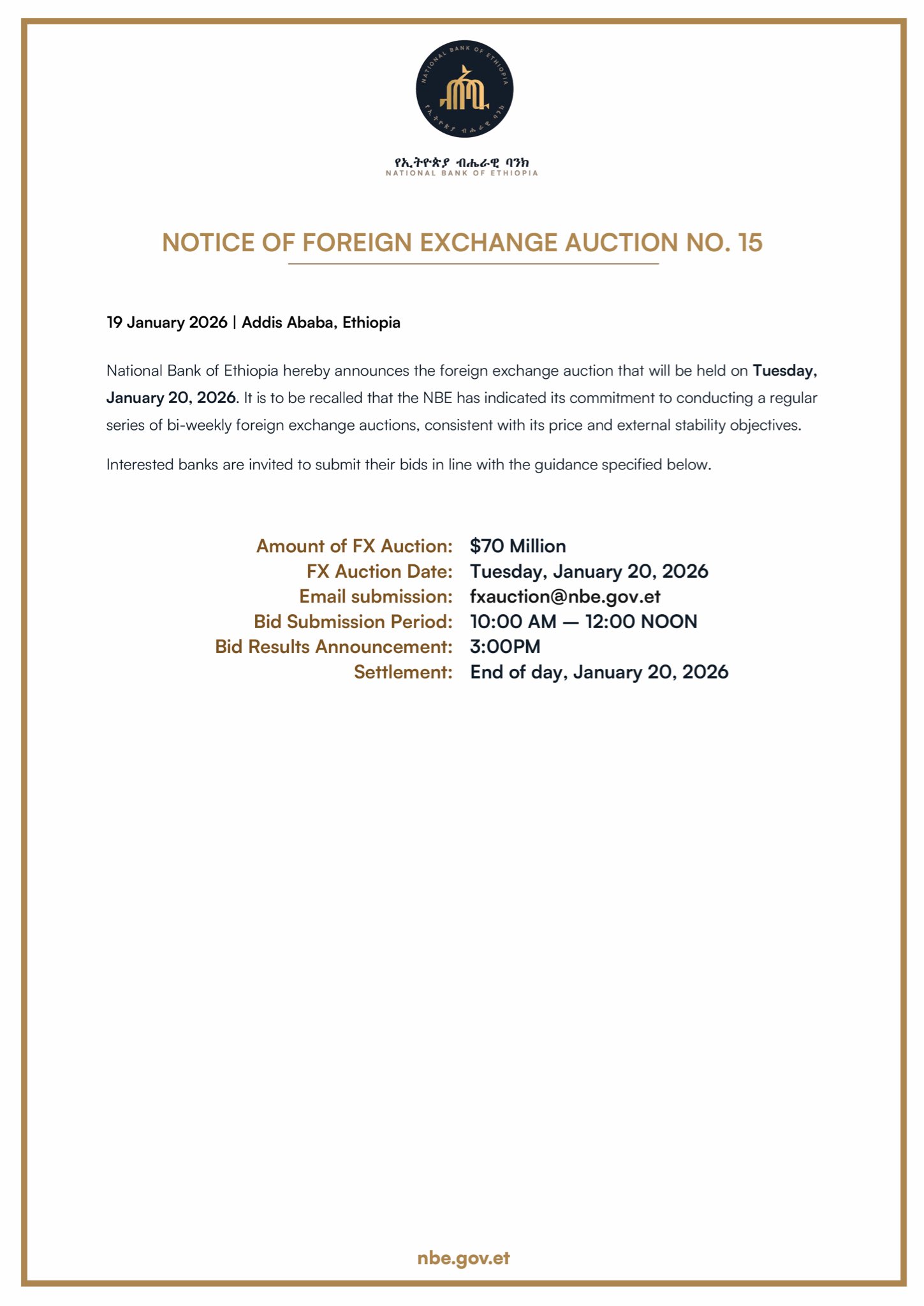

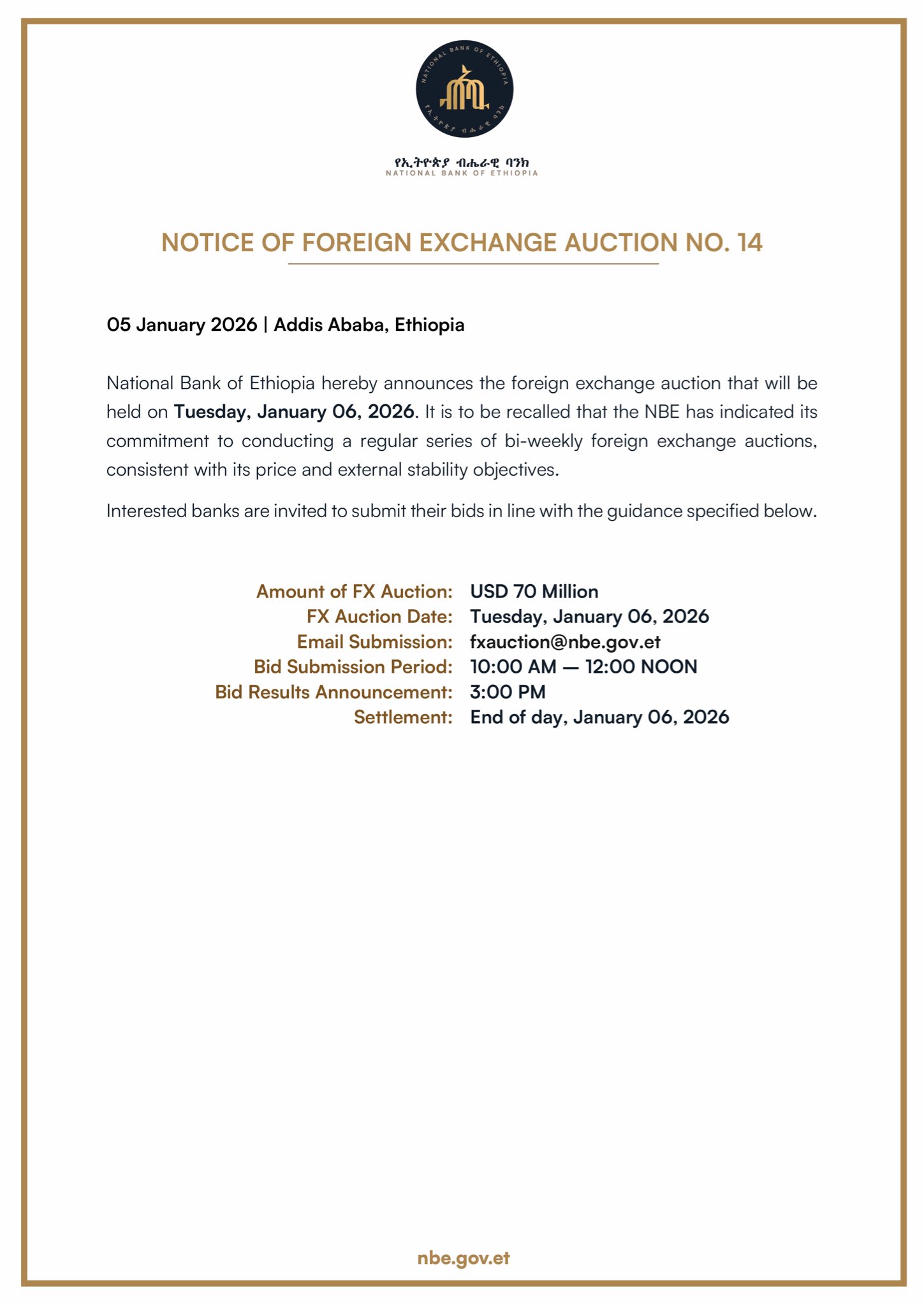

The National Bank of Ethiopia hereby announces that it will be starting a regular series of foreign exchange auctions to be held every two weeks. The auctions will be conducted over a period of several months and are intended to ensure continued stability in Ethiopia’s foreign exchange market.

Since the launch of a comprehensive program of macroeconomic reforms in July 2024, Ethiopia’s balance of payments position has been showing steady and significant improvement, thanks to rising exports, increased remittances, and higher capital inflows. FX reserves at the central bank have reached record levels. In recent months, in particular, the delivery of record high gold supplies to the NBE (which is the sole authorized gold exporter in the country) has boosted the central bank’s gold holdings and increased the level of foreign exchange reserves above initial expectations.

In light of this higher-than-expected foreign exchange position, the NBE has decided to conduct an on-going series of bi-weekly foreign exchange auctions over the coming months. This operation will be providing the private sector with some portion of the foreign exchange accumulation that has been taking place at the central bank and will also aid in helping NBE meet its monetary policy objectives.

Interested banks are invited to submit their bids in the time frame and manner specified below.

Amount of FX Auction: $50 million

FX Auction Date:Tuesday April 1, 2025

Email submission: fxauction@nbe.gov.et

Bid Submission Period: 10am to 12noon

Bid Results Announcement: 3pm

Settlement: End of day April 1, 2025