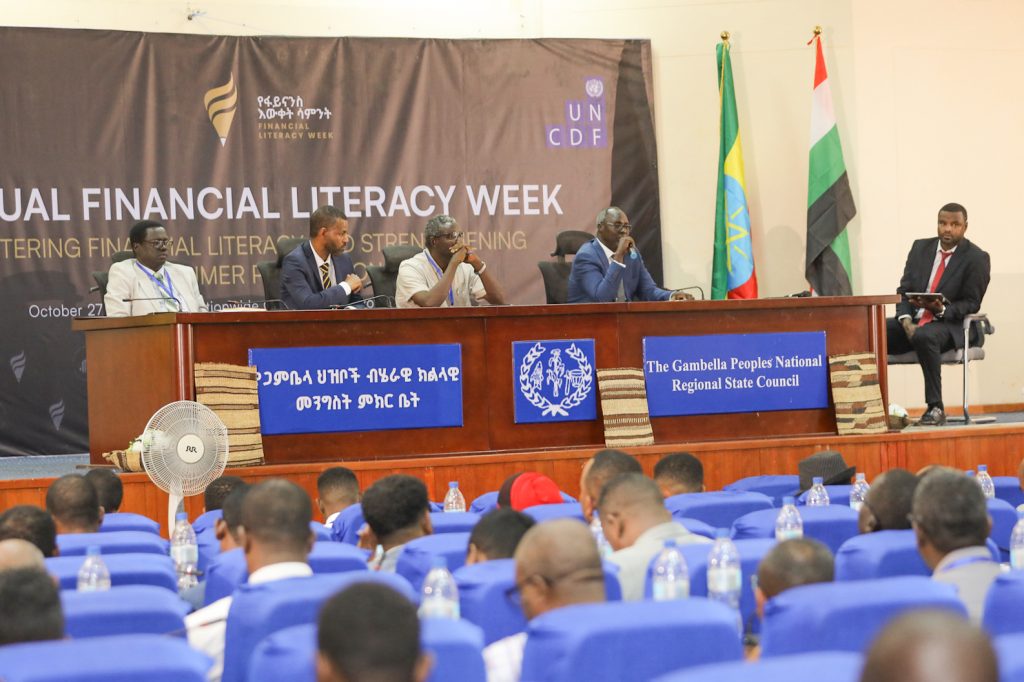

Gambella, October 27, 2025

The National Bank of Ethiopia (NBE), in collaboration with the Gambella Regional State Government, the Financial Inclusion Council, NewFin, and the United Nations Capital Development Fund (UNCDF), is pleased to announce the launch of the first Annual Financial Literacy Week (AFLW), taking place from October 27–31, 2025. The nationwide campaign officially commenced today in the Gambella Region.

Since 2021, the National Bank of Ethiopia has been leading, coordinating, and monitoring the implementation of the National Financial Education Strategy to enhance the financial literacy and well-being of individuals, households, and enterprises, thereby promoting greater financial inclusion across the country.

A key component of this strategy is the rollout of financial education programs (campaigns) targeting rural women and youth, implemented through coordinated efforts among financial institutions, federal and regional government bodies, and development partners.

This year’s Annual Financial Literacy Week is celebrated under the theme “Fostering Financial Literacy and Strengthening Consumer Protection.”

The campaign aims to promote informed financial decision-making and improve the financial well-being of individuals, households, and enterprises throughout Ethiopia, with a particular focus on digital literacy and women in rural areas.

The emphasis on women reflects the significant gender gap in financial inclusion and digital literacy. Moreover, the rapid expansion of digital financial services underscores the need for improved digital literacy to mitigate consumer risks such as fraud and data misuse.

Throughout the week (October 27–31, 2025), under the leadership of the National Bank of Ethiopia, financial institutions and regional financial inclusion councils will undertake a range of outreach and awareness activities, including:

- Launching Financial Literacy Week 2025 in Gambella

- Displaying banners and educational materials in all financial institution branches and Regional Bureaus

- Engaging communities with low levels of financial literacy at their branches

- Disseminating financial awareness messages via roadshows, SMS, brochures, leaflets, mass media, and social media platforms

- Conducting workshops and community discussions in Gambella City targeting rural populations, youth, and women to promote financial inclusion and responsible usage of financial services

Through these coordinated efforts, approximately three million adults (of whom 50% are women) nationwide will be reached and educated on the benefits of opening and using mobile money accounts.